The daily headlines paint a very clear picture of the tragic and devastating human toll that Ukrainians are suffering at the hands of Russian invasion. What is also a threat, although not on the front pages of newspapers, is the very real danger of a balance of payments mismatch that risks a destabilising macro crisis. Ukraine has a large and growing need for dollars to finance critical imports and steady its economy. Public sector help includes additional financial assistance beyond the $30 billion pledged by western partners1 and a realistic path towards EU membership to anchor the structural reforms required for long-term economic success. The private sector can also help by granting the authorities’ request for a two-year standstill on Eurobond debt service.

We believe this combined private/public sector approach to stabilise Ukraine’s finances and accelerate reconstruction is in the best interests of both Ukraine and bondholders and will allow all stakeholders to participate in the gains from recovery.

A large and growing need for dollars to finance essential imports

The Ukraine central bank estimates the economy will contract by a third in 20222, leading to collapsing tax revenues while spending on military and social support surges. The result could be a massive budget deficit of roughly -30% GDP and a total debt stock set to rise north of 100% GDP by year-end. Ukraine’s Ministry of Finance estimates the country’s funding requirement at $5 billion a month3. But western aid commitments have not been disbursed fast enough to fill this gap, forcing fiscal authorities to rely on the central bank for deficit monetisation through money-printing.

Authorities are committed to a return to orthodoxy, but with markets strained and western funding lagging, the central bank remains the lender of last resort. To prevent fiscal dominance from destabilising inflation expectations, the central bank has supported the hryvnia by selling currency (FX) reserves even as it continues to print.

Combined with the decline in exports as Ukraine’s ports remain blocked, a significant external funding gap has emerged. Despite a recent international agreement to reopen Ukraine ports, implementation faces many challenges including lack of cargo insurability given risks of transiting through an active war zone. The Ukrainian central bank responded to these shocks in commendable fashion by initially anchoring inflation expectations via a stable currency and hiking policy rates to 25%. Unfortunately, western financial disbursements from March-July were not enough to prevent a massive loss of currency reserves (around $10 billion year-to- date through June). This reserve drawdown necessitated a devaluation of the official exchange rate on 21 July and a tightening in FX and capital controls.

The Ukraine central bank’s actions will slow dollarisation, temper import demand and reduce the arbitrage that was draining FX reserves as the central bank defended the peg. But the source of the problem – excess local currency liquidity due to deficit monetisation – remains unchanged. Without additional hard currency liquidity support the country risks running down reserves to precarious levels. The resulting devaluation/inflation spiral will be a setback to both Ukraine’s heroic efforts in the war as well as the subsequent reconstruction of its economy.

We support private sector assistance to ease the burden

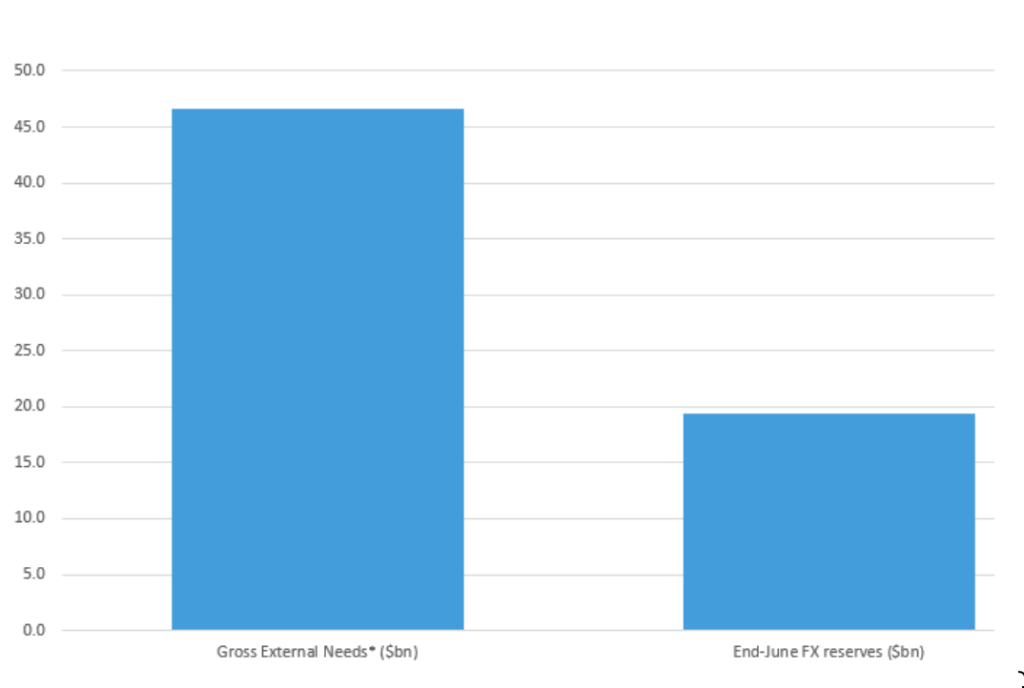

As investors we can help reduce the odds of Ukraine tipping into a full-blown balance of payments crisis by supporting authorities’ request for a two-year deferral of Eurobond debt servicing4. Had the proposal been rejected, the Ukraine Ministry of Finance, wary of entering into a hard default, had pre-committed to pay these sums on the original due dates. Therefore, by rejecting the request bondholders would have been actively draining around $6 billion from Ukraine’s limited FX reserve holdings over the next two years. On 9 August, by voting to accept the standstill proposal5, the global asset management industry rightfully decided to put its money where its mouth was regarding its pledged commitment to a broader stakeholder-based approach. While direct financing of Ukraine’s reconstruction will be considered later, the first step was to support the requested debt service deferral. Doing so has reduced external financing needs and freed up scarce resources at a time when the country needs to conserve FX for critical imports of military equipment, energy and medical supplies (Figure 1).

Figure 1: Ukraine’s financing needs for the next two years

Source: Columbia Threadneedle analysis of current account deficit, external debt service and other private financial outflows, August 2022

Approval of the proposal is consistent with asset managers’ fiduciary duty to end-clients. Ukraine’s Eurobonds currently trade at 20 cents on the dollar, already pricing in a much deeper restructuring than this two-year standstill proposal. The length of the war and severity of the destruction of Ukraine’s capital stock/productivity will ultimately determine recovery values for bondholders. But avoiding a macro crisis will no doubt increase the odds that a post-war Ukraine is able to accommodate higher recoveries and maximise value for investors. By helping Ukraine in its time of need, investors lay the groundwork for potentially realising asymmetric upside returns. We believe in advancing a stakeholder-based approach to emerging markets investing while fulfilling our fiduciary duty, and that accepting the standstill proposal is a win/win for both Ukraine and our clients.